If you have a FICO® score of 650 (which is considered “fair”) or below, it can affect your ability to purchase some of life’s bigger transactions, like buying a car or getting a mortgage for a house. That’s a position no one wants to be in, but there is hope in that there are steps you can take to improve your credit score. Keep in mind, building good credit takes time. It won’t happen overnight, but if you take these steps, you’ll be well on your way to better credit.

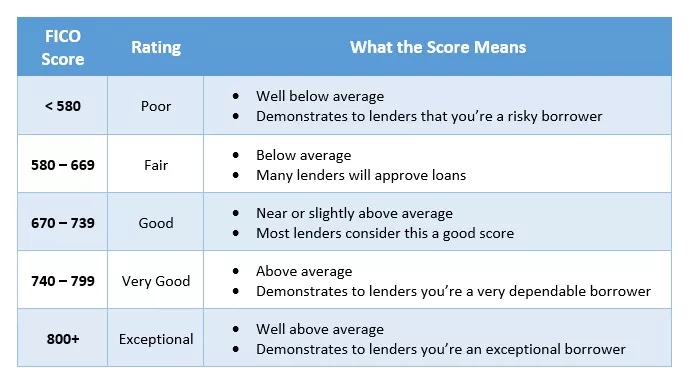

Understanding your FICO score – A FICO score is a number generated by the Fair Isaac Corporation (from which FICO gets its name) from 0 to around 800 that many lenders use to determine if they want to lend you credit (such as loans, mortgages, credit cards, etc). The higher your number, the better of a rating you have, and a better chance of getting credit. According to this picture from Investopedia.com, generally, you want to be above 580 to be eligible for credit.

Understanding your FICO score – A FICO score is a number generated by the Fair Isaac Corporation (from which FICO gets its name) from 0 to around 800 that many lenders use to determine if they want to lend you credit (such as loans, mortgages, credit cards, etc). The higher your number, the better of a rating you have, and a better chance of getting credit. According to this picture from Investopedia.com, generally, you want to be above 580 to be eligible for credit.- Make sure your credit reports are accurate – Checking your own credit reports has no effect on your score, so it’s recommended that you check your credit report from all three agencies: Equifax, Experian and TransUnion. Check for inaccuracies or missing information. If you find something wrong, contact the reporting agency and your lender. Here is more information on what to look for and how to fix errors.

- Pay your bills on time – Making payments on time makes up 35% of your FICO® score. If you have trouble making payments on time, you can set up payment alerts or have the payments taken out of your bank account automatically. If you have a late payment history on an account, you may be able to work with the creditor to have the negative mark removed. Of course, if you are behind on your payments, it’s recommended that you quickly bring your account up to date. If you are having trouble making your payments, talk to your creditor or a credit counseling service.

- Reduce the amount of debt you owe – Your credit use makes up 30% of your FICO® score. Credit use is determined by the balance you carry compared to the amount of credit available to you. Ideally, you want to keep your utilization rate at about 30%, so if you have $25,000 of available credit, you’ll want to keep the balance you owe to around $7,500.

- Don’t close unused credit accounts – The age of your credit makes up 15% of your FICO® score. The older your credit is, the better you look to lenders. Also, if you have credit accounts open that you’re not using, closing them would lower your available credit and as a result, lower your credit score. If you still want to close some of your accounts, opt for the newer ones. Be aware, though, that closing accounts does not take them off of your credit history.

- Pay down maxed-out cards first – You might have heard that it’s better to pay off smaller credit cards first, but org actually advises consumers to pay off credit cards that are close to being maxed out first. This will bring down your credit utilization rate.

- Limit hard inquiries into your credit – When you apply for new credit, such as a new credit card, a car loan or a mortgage, a “hard inquiry” usually takes place. This is when a financial institution looks into your credit history to decide if they want to lend you the credit. One of these checks can bring your credit score down a few points for a while, which isn’t too harmful, but too many checks in a short amount of time can add up. If you’re trying to improve your credit, it’s best to avoid a lot of hard inquiries into your credit.

- Get added as an authorized user – If you have a friend or family member with good credit and they are willing to let you, you could possibly get added to one of their accounts as an authorized user. As a result, their good credit would get added to your credit record. (Note: You don’t have to actually use the credit.)

- Open a secured credit card – This involves depositing money into a checking account to act as a backup to a line of credit. The payments will come out of that account automatically and will always be paid on time.

- Increase your credit limits – Once you have established a solid payment history, a creditor may be willing to increase your credit limit. This will get you closer to 30% credit utilization and increase your score.

Having a good credit score can really help you make those bigger purchases, like that future home. Keep these tips in mind while you are working on your credit score and when you are ready to look into some local real estate, I’d be happy to help!

Having a good credit score can really help you make those bigger purchases, like that future home. Keep these tips in mind while you are working on your credit score and when you are ready to look into some local real estate, I’d be happy to help!

Looking for real estate services in Gainesville, Haymarket or Bristow? Contact your local real estate expert Belinda Jacobson-Loehle of Jacobson Realty and Home Staging In Gainesville, Virginia today. Also be sure to sign up now for a FREE copy of my eBook, “The Real Estate Key – What You Need to Know!”

3,711 total views, 2 views today